What is happening?

In its Aug. 15, 2025 report, Scorpion alleged that Vykat XR carries serious safety risks and could even face market withdrawal, while also questioning the integrity of Soleno’s clinical evidence and publications (including claims of red flags around trial data and physician-authored papers); the disclosure of Scorpion’s short sent SLNO down ~8–13% on the day and triggered multiple plaintiff-firm probes, and shares fell a further ~12–14% on Sept. 10 after Soleno later disclosed a patient death.

Scorpion Capital is an activist short-selling firm founded and run by Kir Kahlon that publishes long, forensic reports—often 50–150+ pages—built around undercover/primary interviews, document reviews, and aggressive fraud-focused narratives. They’ve targeted a mix of life sciences and hard-tech names (e.g., Ginkgo Bioworks, Berkeley Lights, QuantumScape, IonQ, and Lasertec), in the past.

Scorpion’s claims have little grounding in reality; not least, the report has created a phenomenal buying opportunity.

This short post will address all the major points of the report.

Prader–Willi Syndrome (PWS): Disease Background

Prader–Willi syndrome (PWS) is neurogenetic disorder caused by loss of genes on chromosome 15q11–q13, characterized in infancy by hypotonia and feeding difficulties and, later, by hyperphagia with severe obesity, endocrine dysfunction (short stature, hypogonadism), cognitive/behavioral issues, and sleep-disordered breathing.

Its prevalence is about 1 in 10,000–30,000 births worldwide. Mortality is substantially higher than in the general population (median life expectancy of 30 years), with a significant burden on quality of life.

They are really hungry

VYKAT XR (diazoxide choline ER)

In March 2025, the FDA approved VYKAT XR (diazoxide choline extended-release) as the first drug to treat hyperphagia in PWS (ages ≥4), offering pharmacologic control of the syndrome’s hallmark hunger. This represented the first disease-specific pharmacotherapy targeting the hyperphagia axis in PWS, shifting standard of care from purely behavioral/endocrine management toward adjunctive pharmacologic appetite control.

IP exclusivity

Composition of matter patent expires in Mar 5, 2029, and the full 5-year PTE is likely to be granted by the FDA to make up for the time lost in review and clinical trials + 6 months of pediatric exclusivity expected. This pushes the CoM expiration to around September of 2034, after which the formulation patents still remain. Even if these patents provided no protection, Soleno could still delay entry to the market by at least 30 months by “negotiating” with generic entrants via most favored entry and other hidden reverse payments, providing exclusivity for the drug until EO2036.

On-label (PWS) TAM is 10k people, with potential off-label uses. With a 400k annual net price, realistic peak sales are in the $1.8–$2.6 billion range, as indicated by management. This compares to an EV of 2.97 bln with a net cash of $450 million at a share price of $59. Early commercial companies usually trade around 3x peak sales, indicating a share price of $100 with a mid guidance peak sales figure.

Real-World Safety Signal (FAERS) and Mortality

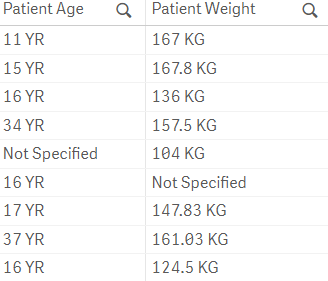

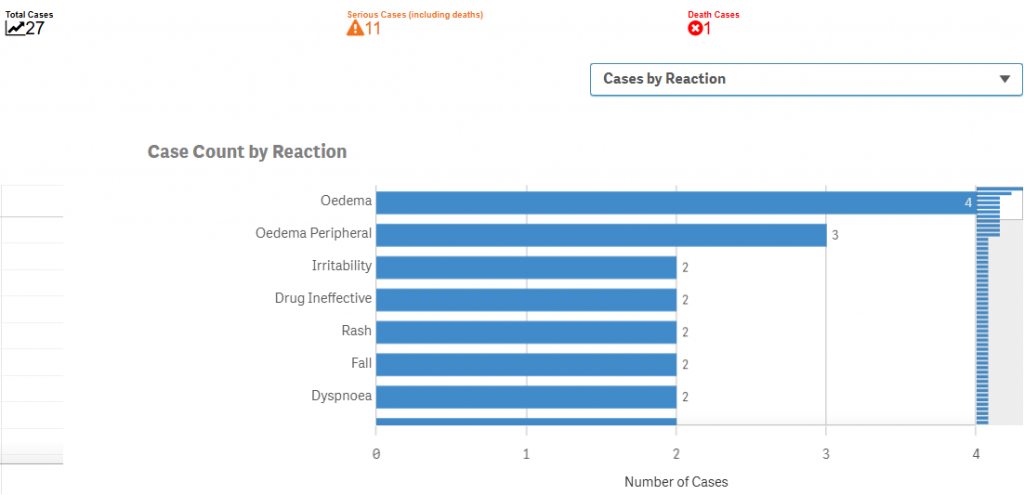

Toxicity of the drug: As of the end of Q2, 646 patients have started the treatment, and current numbers are probably closer to at least a 1000 patients based on extrapolation from past adaptation trends, and an additional 125 patients have taken part in the trials. In FAERS (FDA’s drug reaction reporting database where every serious adverse event of patients has to be reported, regardless of causation), we only see the following:

At a background mortality of 3–4% annually in PWS, (about) 500 patient-years predicts ~15–20 deaths; the observed count is only 1, indicating the drug reduces hyperphagia-related risk in PWS, refuting Scorpion Capital’s claims about Vykat’s supposed ineffectiveness.

The only death that has occurred was deemed unrelated by doctors. The 17-year-old patient died of pulmonary embolous (blood clot in the lungs), which is completely unrelated to the drug’s mechanism of action. Regardless, the stock was down 12% on the news.

Although oedema (fluid swelling) rates are higher ~0.6%, the significant mortality risk reduction trumps the oedema-induced inconveniences (oedemas are most of the time Grade 1 & Grade 2 AEs, rarely ever grade 3).

Competitors

($Acad) Acadia failed its P3 trial in September, but to no avail $SLNO still sold off. ($aard) Aardvark Therapeutics is in P3 trials with top-line readout expected in Q3 2026, and market entry early 2028, but combo friendly. $rytm phase 2 open-label data coming up, but supports combo use with Vykat Rx.

In general, given VYKAT’s mechanism, the most plausible competitive scenario is combination therapy rather than wholesale displacement, as emerging agents modulate distinct appetite or energy-balance pathways.

Near-Term Setup: Q3 beat based on FAERS-Inferred Uptake

With Q3 earnings coming up at the beginning of November and a consensus revenue of only $46 million. With the estimated monthly net price of $31k a month, $46 million only implies 494 patients actively on therapy, which is lower than the 646 patients who have started the therapy by the end of Q2 (churn is minimal, AE related discontinuation is only 5%). $46 million looks low even if no new patients have started the therapy, which is not the case.

FAERS database indicates a much higher rate of uptake: as dose-related AEs like hyperglycemia and edema typically cluster in the first ~0–30 days after initiation for K_ATP openers, the frequency of reports should track new prescriptions by about a month. The number of expedited/direct cases grew from 0 to 10 from Q2 to Q3, indicating an accelerating uptake.

The earnings beat, combined with the decaying toxicity fears caused by the Scorpion report should provide near-term catalysts for value realization, and $SLNO should retest its new highs by the end of the year.