I expect Soleno, not just to beat the $47 mln street estimates in Q3, but all estimates I have seen on X, which ranged roughly from 75-85 mln. Others have based their models on soft-coded assumptions (most important of which is the average price), whereas I only assumed the launch curve in Q2 – for which we have many datapoints, so my estimates are probably pretty close to the ground truth- and back-solved for the price so that Q2 revenue ($32.7 mln) matches the reported figure. This model predicts 91 mln Q3 revenue.

Why is sell-side wrong?

1.0 Weight: It is unclear what the average weight of PWS patients, and as always sell side is more focused on not being wrong rather than being right (note that these are not completely complimentary sets) by basing their estimations on data points they can cite in case their predictions disappoint: “We acknowledge that the figure may err on the conservative side but is in-line with the average from the clinical studies of Vykat XR.”-GS.

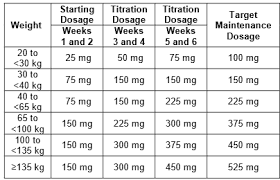

In the trial, the average age was 13.4 (vs 22 in hospitalisation claims), making the average weight 62.1 kgs, which the Goldman estimate is based on. The trial was originally designed for 8+ yr patients, but the 4-8 cohort was added later and probably enrolled relatively many more patients to preserve the statistical power of the study, from the required p adjustment, would that cohort be subject to any ad hoc analysis (unclear if it was eventually subjected to any analysis of this sort). This change in trial design led to an unrepresentative sample of the PWS population enrolled in the trial

Mgmt noted in the earnings call that they see significantly heavier patients than in the trials, corroborating my line of reasoning.

2.0 Lack of data: Vykat RX is a specialty drug with recent approval, making the sampling-based data of Symphony extremely noisy. The problem is exacerbated by the fact that only a single specialty pharmacy is distributing it, making data providers rely only on insurance data, as Panther shares minimal data.

This is a highly unusual situation for sell-side analysts who just copy-paste sales estimates from IQVIA or other data providers, so as always, they rolled with the defensible rather than the right assumptions.

What did I factor in that others seemingly did not?

1.0: Tritration: All of the people on X (and sell-side) have modeled with linear dosing, but the need for titration-based models was articulated by many people, yet no one seemed to create one, so I decided to create the first one.

Titration plays a crucial role in my model, as it significantly pushes down doses for patients and therefore pushing up the implied average dose.

2.0 delay Time to fill + free drug days:

646 scripts were written by the end of Q2, but the exact number filled is unknown. Since the drug requires prior authorization, a 7-day script to revenue conversion is reasonable. On top of that, since Q2 was the first quarter of selling the drug, hence the coverage was erratic, so Soleno introduced Soleno One, which gives patients free drugs for up to 28 days if their insurer does not approve in 10 days, so I assumed an average of 14 free drug days.

Why does this change the math? This 21-day script to the revenue cycle significantly decreases the number of dispensed paid doses in Q2 and thereby pushes up the implied average price, which we are solving for.

Conclusion:

I believe Soleno had a large number of patients, on free drugs/ waiting for payer authorization, who were converted into paying customers at the beginning of Q3, hence the explosive revenue growth.